If you’re a healthcare provider in Kansas, you’ve likely heard the term “revenue cycle” more times than you can count. But what does it mean, and why is it so important?

The revenue cycle includes every step your facility or practice takes to receive payment for the services you provide. It starts when a patient schedules an appointment and ends when you receive the final payment. Along the way, it involves tasks like insurance verification, billing, coding, claim submission, and patient collections.

When the revenue cycle runs smoothly, your organization maintains financial stability, your staff operates more efficiently, and your patients enjoy a better experience. However, issues like incorrect coding or delays in claim submission can lead to lost revenue, frustrated patients, and potential compliance problems.

For Kansas providers—especially those working with Medicaid through KanCare or serving rural communities—there are a few additional challenges to consider. That’s why it’s essential to understand each stage of the cycle and recognize where things can go wrong.

In this guide, we’ll walk through every step of the healthcare revenue cycle, explain how it works in clear language, and share tips to help Kansas providers strengthen their processes and avoid common pitfalls.

What is the Healthcare Revenue Cycle?

The healthcare revenue cycle encompasses the entire process a provider follows to receive payment for their services. It begins when a patient schedules an appointment and continues until the provider accepts all costs, whether from the patient or their insurance.

The following are the steps included :

- Collecting patient information and verifying insurance coverage

- Documented the care provided

- Submitting claims to insurance companies

- Processing payments and handling all the billing issues

- Following up on unpaid bills or denied claims

Every step matters because any snag along the way can cause inaccurate or delayed payments. For example, if insurance details aren’t verified at the start, a claim may get denied later.

For providers in Kansas, understanding this cycle is crucial. State programs, such as KanCare, have specific rules, and many providers serve patients in rural areas with diverse payer mixes.

Simply put, the revenue cycle ensures that money flows smoothly, allowing providers to focus on what matters most: patient care.

Key Strategies of the Revenue Cycle Process

The revenue cycle comprises several steps, each playing a crucial role in ensuring that your practice receives accurate and timely payments. Whether you run a small family practice in rural Kansas, understanding these steps helps you prevent delays and improve your bottom line.

Patient Registration & Eligibility Verification

The revenue cycle begins before the patient even walks into the hospital. During registration, your front desk staff collects essential information, such as contact details, insurance coverage, and the purpose of the visit.

Insurance Eligibility verification plays a crucial role. This step confirms whether the patient’s insurance is active and which services it covers. Verifying coverage upfront helps prevent denied claims and avoids surprises for patients later.

Charge Capture & Accurate Coding

Once a provider delivers services, everything that happens during the visit must be documented appropriately and translated into medical codes. It includes CPT codes for procedures and ICD-10 codes for diagnoses.

Inaccurate or incomplete coding can lead to delayed, denied, or underpaid claims. That’s why it’s essential to have trained staff or reliable coding software that ensures accuracy from the start.

Timely Claim Submission

After coding, your team should submit claims to insurance companies as quickly as possible—ideally within 24 to 72 hours of the visit. Delays in claim submission can slow down payments and increase the risk of unnoticed errors.

Using an electronic claims system helps identify mistakes before claims are sent out, improving accuracy and speeding up reimbursement.

Payment Posting and Adjustments

Once your team submits a claim, payers respond with payments or explanations of benefits (EOBs). At this stage, your billing staff records the payment, applies contractual adjustments, and posts any remaining balance to the patient’s account.

Accurate payment posting enables you to monitor revenue trends and identify underpayments promptly.

Denial Management and Appeals

However, not all claims get processed successfully. Denials happen, and how your team handles them makes a big difference.

When a claim is denied, your staff should promptly identify the reason, correct any errors, and resubmit the claim or file an appeal. By tracking denial trends, you can identify and address underlying issues, thereby preventing recurring mistakes.

A/R Follow-Up and Recovery

The goal of accounts receivable (A/R) follow-up is to ensure that unpaid balances—from patients or insurance providers—get paid. The process may involve making follow-up calls, offering payment plans, or sending accounts to collections.

Staying on top of accounts receivable (A/R) helps maintain cash flow and reduces long-term write-offs.

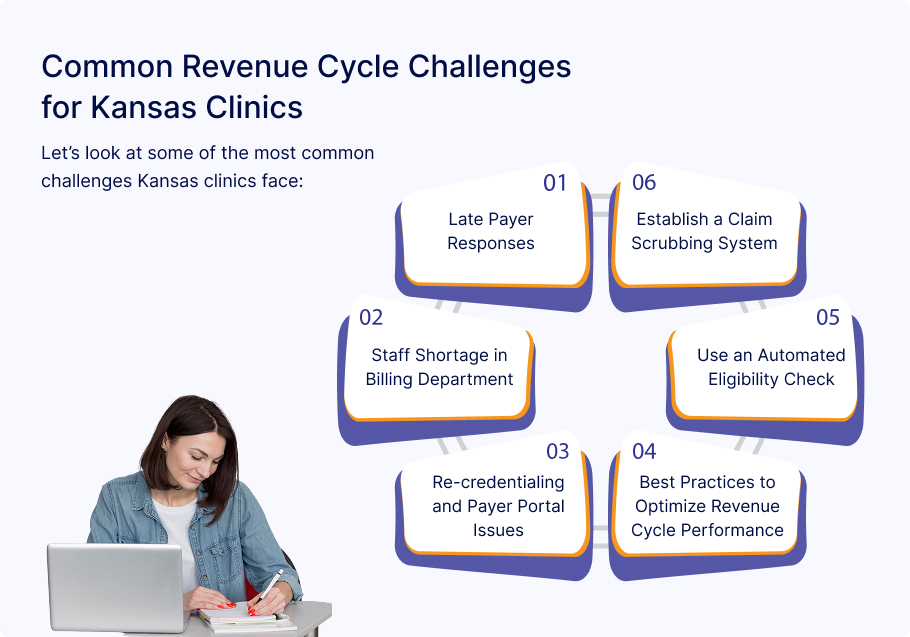

Common Revenue Cycle Challenges for Kansas Clinics

Managing a healthcare clinic in Kansas comes with unique challenges, including revenue cycle management (RCM). These problems can slow down reimbursement and significantly impact cash flow, particularly for smaller practices. Let’s look at some of the most common challenges Kansas clinics face:

Late Payer Responses

One of the most frustrating aspects of being a Kansas provider is dealing with slow responses from insurance payers, such as Blue Cross Blue Shield (BCBS) and KanCare. Claims are frequently left in the dark about when or whether they will receive payment while claims are being reviewed, sometimes for weeks. These delays can result in revenue loss and require additional time and effort to follow up.

Staff Shortage in Billing Department

The healthcare sector, like many other sectors, is facing a staff shortage, and billing departments are no exception. Many clinics in Kansas have small teams, and the entire revenue cycle may be slowed down if even one biller is absent. Without enough staff to submit claims, post payments, or handle denials, clinicians may face growing backlogs and delayed payments.

Re-credentialing and Payer Portal Issues

Re-credentialing is a routine task that can quickly become a significant headache. Many Kansas clinics encounter long wait times pr confusing steps when trying to update provider credentials with payers. Moreover, payer portals may be unreliable or outdated, making it challenging to monitor claim statuses or promptly address issues. These technical and administrative issues can lead to claim rejections or delays in enrollment, directly affecting cash flow.

Best Practices to Optimize Revenue Cycle Performance

Improving your clinic’s revenue cycle does not always require a complete redesign. Making minor adjustments consistently can improve cash flow and reduce billing issues. Kansas healthcare providers can maximize revenue cycle performance by implementing the following best practices:

Use an Automated Eligibility Check

Verifying a patient’s insurance coverage is crucial before they even enter the hospital. Automated eligibility checks make this faster and more accurate. These solutions help your front desk verify active coverage and deductibles by retrieving real-time data from insurance payers. This step reduces claim denials and helps patients understand their financial responsibilities.

Establish a Claim Scrubbing System

Claim scrubbing software reviews claims before they are submitted, which identifies common errors, including missing codes, incorrect modifiers, or mismatched patient data. Clean claims are more likely to be paid on the first attempt. Your clinic can save time and reduce denials that cause payment delays by identifying problems at an early stage.

Monitor KPIs (Days in AR, First-Pass Rate, Denial Rate)

Key performance indicators (KPIs) give you a clear picture of how well your revenue cycle is working. The following are a few of the most crucial KPIs to monitor:

- Days in Accounts Receivable (AR): How long does ot take ot get paid after a service is provided?

- First-Pass Resolution Rate: The percentage of claims paid without any rework.

- Denial Rate: The percentage of claims denied by payers.

Monitoring these regularly helps you spot trends, identify problem areas, and make informed improvements.

Partner with a Kansas-based Billing Company

Outsourcing to a local medical billing company can make a big difference, especially for small and mid-sized clinics. Billing partners in Kansas, like Kansas Medical Billing, are familiar with regional payer policies and can provide personalized support. They may have existing relationships with BCBS, KanCare, and other insurers, which can expedite the credentialing and claim resolution process; moreover, collaborating with a local team results in improved communication and quicker responses.

How Kansas Billing Supports Kansas Providers with RCM

Kansas Medical Billing supports healthcare providers in Kansas by offering flexible, hands-on revenue cycle management solutions tailored to meet the needs of each clinic. Whether you require full-service billing or assistance with particular activities, we begin by creating a customized billing workflow that complements your current procedures and workforce structure. To keep you informed and in control, we provide detailed monthly reports, along with denial analytics, which help you understand claim performance and identify recurring issues. However, to ensure that your providers remain enrolled and prevent reimbursement delays, we also manage credentialing and recredentialing with Kansas payers, including BCBS and KanCare.

Most importantly, our team ensures that your revenue stays on track by following through on every claim, from submission to payment.

Final Thoughts

For Kansas clinics, a strong revenue cycle is more than just billing; it is about consistent processes, using the right tools, and having reliable support in place. Every action affects your financial well-being, from managing staff shortage and payer delays to enhancing claim accuracy and monitoring essential performance indicators. Kansas healthcare providers can reduce stress, boost payments, and focus more on patient care by implementing best practices and collaborating with an experienced RCM supplier .